Each week Emerging Markets ESG publishes an interview entitled, “Five Questions about SRI.: The interview features a practitioner’s insights about SRI in emerging markets and through Emerging Markets ESG shares this expertise with a wide global audience. The goals of Five Questions about SRI are fourfold:

-

To reflect on what SRI in emerging markets means to practitioners;

-

To collect a catalogue of examples of SRI in practice in emerging markets;

-

To raise awareness about SRI in emerging markets; and

-

To enable SRI practitioners in emerging markets to network with peers around the world.

This week’s interview is with Dr. William Cox, CEO, Management & Excellence S.A., Madrid, Spain.

Management & Excellence (M&E) is a leader in auditing, rating, consulting, calculating returns on intangibles and research services in connection with the financial sustainability of companies. Since 2001, M&E has developed services which today can reliably quantify the free cash flows generated by virtually any project including those in the areas of governance, ethics, social and environmental responsibility, training, IT, marketing and transparency, among others. It can financially quantify the management and business processes of an entire company and help to accurately project its likely financial success. M&E set up operations in 2006 in Brazil and is present in the USA and Hong Kong via partnerships.

Dr. William Cox has over 25 years’ experience in advising companies in Europe, Latin America and the U.S., from all industries, as well as governmental institutions and associations, for CoxComm GmbH, Hill & Knowlton and Burson-Marsteller in Zurich, Frankfurt, New York, Hamburg and Madrid. Cox published six books in Germany, the USA and Spain, in addition to several hundred articles on business topics worldwide and is a member of Who’s Who in Germany, Austria and Switzerland. He earned a Ph.D. from the London School of Economics and graduate degrees from University of Oxford (finance) and Boston University (philosophy and political science), as well as a postgraduate certificate from Harvard Kennedy School (macro finance).

Emerging Markets ESG: How would you define socially responsible investment (SRI)?

William Cox: The definition of ESG investing is becoming broader to include such areas in companies as corporate culture, training, client relations and risk management—areas likely to impact financials. This broadening ESG definition makes it easier to include investments in all types of management and governance oriented investments. Accordingly, Campden Research estimated global ESG investment volume at $5 trillion in May 2011. Other sources include all investments of UN PRI institutions, thus exceeding $30 trillion. Campden expects a compounded annual growth rate (CAGR) for ESG investments for coming years of 25%. I would suspect that a lot of this money is due to a redefinition of “ESG investing” rather than money truly moving from mainstream to ESG.

William Cox: The definition of ESG investing is becoming broader to include such areas in companies as corporate culture, training, client relations and risk management—areas likely to impact financials. This broadening ESG definition makes it easier to include investments in all types of management and governance oriented investments. Accordingly, Campden Research estimated global ESG investment volume at $5 trillion in May 2011. Other sources include all investments of UN PRI institutions, thus exceeding $30 trillion. Campden expects a compounded annual growth rate (CAGR) for ESG investments for coming years of 25%. I would suspect that a lot of this money is due to a redefinition of “ESG investing” rather than money truly moving from mainstream to ESG.

The distinction between ESG and mainstream is becoming so blurred that either term may disappear in a few years.

The fact that most ESG strategies worldwide are for equities (57% according to Mercer Consulting, 2011), shows that ESG is increasingly being seen as a varied group of value drivers underlying corporate performance.

As such, Brazilian bluechips are doing their part in connecting ESG factors with financial results by integrating sustainability and annual reports into single documents, and investors, such as SAM (DJSI), use ratios relating ESG costs to financials. M&E, for example, also uses its own ratios such as (1 cent of earnings/ executive remuneration) to gage executive effectiveness for shareholders.

Yet the main defect is still the absence of an effective ESG accounting system. GRI is convoluted and does not relate ESG indicators to financial data. A 2013 survey by M&E, LatinFinance and Itau among analysts and investors worldwide revealed that sustainability was the area they regarded least in their investment decisions.

Emerging Markets ESG: What distinguishes SRI from mainstream investment?

William Cox: Very little – as noted above. ESG is no longer very “green” and management is no longer very “black”. However, perhaps a more fundamental distinction is that ESG investors tend to be more long term. An Aug 2012 study by BSR, a sustainability network, sites that pension funds and other long-term investors are leading the way in SRI.

Emerging Markets ESG: Which extra-financial theme – environmental, social or governance – is the most challenging for companies in Brazil to manage?

William Cox: That depends on their sector. If you are an industrial company– such as Vale, the Brazilian mining company, you worry about environmental compliance. If you are a major bank – governance and social performance are priorities. In any case, a poor performance can entail negative financial impacts. A high absenteeism rate can mean impacts of hundreds of millions of US$ of employee costs without any return. When Itau and Unibanco, the Brazilian banks, merged in 2009 their absenteeism rate increased to 0.94%, which meant that over US$250 mn in employee costs alone were lost. Lost revenues and negative impacts on operating margins are likely to have been much higher. A concerted corporate culture program brought absenteeism rates down considerably, but this took another 2-3 years to realize.

Emerging Markets ESG: Which extra-financial theme – environmental, social or governance – is the most challenging for investors in Brazilian companies to analyze?

William Cox: While analysts and investors in Brazilian companies seem to accept that ESG is a good thing, there is a lack of an established method to show the financial returns of ESG projects within companies. The large Brazilian banks, such as Bradesco and Itau are implementing systems which will allow them to measure and monitor the financial ROI of their numerous social projects—many of which are designed to create an efficient internal corporate and operating culture.

Such methods will later allow companies to more rationally allocate funds to ESG projects which are yielding the highest returns. ESG would then enter a more rational financial management phase, subjecting projects and eventually entire ESG project portfolios to common NPV analyses. M&E pioneered Return on Sustainability—ROS® 5 years ago, which has been used to measure the ROI of projects totaling $5 bn in investments.

Client projects have shown sales training, for example, to yield a financial ROI of 20% to 50% within only a month following the training. Innovation programs and social programs intended to motivate employees take longer to produce a ROI but can easily yield thousands of percent in ROI after 1-2 years. This ROI is often distributed across different lines of the income statement. Sales training mainly impacts revenues, while employee social programs reduce cost positions, elevating net income and thus retained earnings and equity.

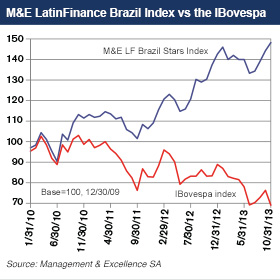

Emerging Markets ESG: The Brazil Stars Index, run by Management & Excellence and LatinFinance (Euromoney) is a portfolio of the 16 best managed blue chips of Brazil as of December 31, 2009. According to M&E, the index financially quantifies management and business processes. Could you please explain the methodology for this analysis and describe the fund’s performance.

William Cox: In simple terms, we analyze 400-850 data points in the four categories of compliance (theoretical performance), actual historic financial and management performance (using our own ratios), the volatility in this performance (risk) and corporate strategy. All these areas generate scores, which are subjected to a calculation yielding a single factor, which is then multiplied by the company´s market cap to produce its total Management Value. This MV, in turn, determines each company´s final weighting in the Index. The result is that the better a company is run, the higher its relative weighting in the Index. Our method has proven to have a strong ability to predict future stock price development because it quantifies current management performance. And this performance is the source of future financial and stock performance.

The method works equally well in other markets, such as Hong Kong/China, where our Hong Kong Stars Index, run together with Asiamoney and BDO Financial, has outperformed the Hang Seng Composite by 28% (Dec 2010-July 2013).